The Pradhan Mantri Jan Dhan Yojana (PMJDY), launched by Prime Minister Narendra Modi in 2014, has completed a decade of successful implementation. PMJDY is the largest financial inclusion initiative globally, providing support to marginalized and economically backward sections through its financial inclusion interventions.

The Prime Minister, Shri Narendra Modi today marked the 10th anniversary of Jan Dhan Yojana, celebrating its significant impact on financial inclusion. The Prime Minister also congratulated all beneficiaries and thanked those who made this yojana a success. Shri Modi said that Jan Dhan Yojana has been paramount in boosting financial inclusion and giving dignity to crores of people, especially women, youth, and the marginalized communities.

The Prime Minister posted on X;

“Today, we mark a momentous occasion— #10YearsOfJanDhan. Congratulations to all the beneficiaries and compliments to all those who worked to make this scheme a success. Jan Dhan Yojana has been paramount in boosting financial inclusion and giving dignity to crores of people, especially women, youth, and the marginalized communities.”

“आज देश के लिए एक ऐतिहासिक दिन है- #10YearsOfJanDhan. इस अवसर पर मैं सभी लाभार्थियों को शुभकामनाएं देता हूं। इस योजना को सफल बनाने के लिए दिन-रात एक करने वाले सभी लोगों को भी बहुत-बहुत बधाई। जन धन योजना करोड़ों देशवासियों, विशेषकर हमारे गरीब भाई-बहनों को आर्थिक रूप से सशक्त बनाने और उन्हें सम्मान के साथ जीवन जीने का अवसर देने में सफल रही है।”

Today, we mark a momentous occasion— #10YearsOfJanDhan. Congratulations to all the beneficiaries and compliments to all those who worked to make this scheme a success. Jan Dhan Yojana has been paramount in boosting financial inclusion and giving dignity to crores of people,… pic.twitter.com/VgC7wMcZE8

— Narendra Modi (@narendramodi) August 28, 2024

On this occasion, Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman, in a message, said, “Universal and affordable access to formal banking services is essential for achieving financial inclusion and empowerment. It integrates the poor into the economic mainstream and plays a crucial role in the development of marginalised communities.”

“It is heartening to note that 67% of the accounts have been opened in rural or semi-urban areas, and 55% of accounts have been opened by women,” the Union Finance Minister said.

In his message on the occasion, Union Minister of State for Finance Shri Pankaj Chaudhary, said, “PMJDY is not only a scheme, but a transformation movement that has enabled financial independence of many of the unbanked population and has instilled a sense of financial security.”

The initiative has transformed the banking and financial landscape of India over the last decade, with 53 crore people brought into the formal banking system through the opening of Jan Dhan Accounts. These accounts have garnered a deposit balance of Rs. 2.3 lakh crore, and resulted in the issuance of over 36 crore free-of-cost RuPay cards, which also provide for a ₹2 lakh accident insurance cover.

The consent-based pipeline created through the linking of Jan Dhan-Mobile-Adhaar has enabled swift, seamless, and transparent transfer of Government welfare schemes to eligible beneficiaries and promoted digital payments. PMJDY provides one basic bank account for every unbanked adult, with no need to maintain any balance and no charges levied on this account. PMJDY account holders are also eligible for getting an overdraft of up to Rs. 10,000 to cover exigencies.

The journey of PMJDY led interventions has produced both transformational and directional change, making the banks and financial institution ecosystem capable of delivering financial services to the poorest of the poor. The PMJDY accounts have been instrumental in receiving Direct Benefit Transfers, serving as a platform for hassle-free subsidies/payments made by the government without any middlemen, seamless transactions, and savings accumulation.

The successful implementation of PMJDY during the last 10 years has seen achieving many milestones. The major aspects and achievements of the PMJDY are presented below.

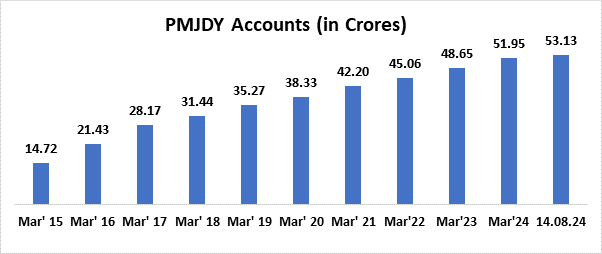

- PMJDY Accounts: 53.13 crore (As on 14th August’24)

As on 14th August 24 number of total PMJDY Accounts: 53.13 crore; 55.6% (29.56 crore) Jan-Dhan account holders are women and 66.6% (35.37 crore) Jan Dhan accounts are in rural and semi-urban areas

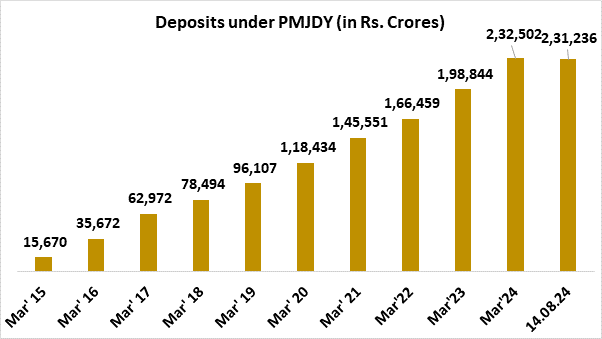

- Deposits under PMJDY accounts – 2.31 Lakh Crore (As on 14th August’24)

Total deposit balances under PMJDY Accounts stand at Rs. 2,31,236 crore. Deposits have increased about 15 times with increase in accounts 3.6 times (Aug’24 / Aug’15)

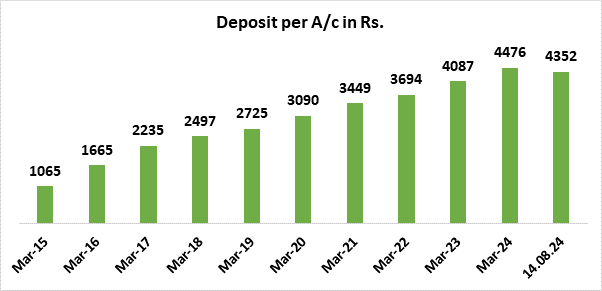

- Average Deposit per PMJDY account – Rs 4352 (As on 14th August’24)

Average deposit per account is Rs. 4,352 as on 14.08.2024. Avg. Deposit per account has increased 4 times over August 15. Increase in average deposit is another indication of increased usage of accounts and inculcation of saving habit among account holders

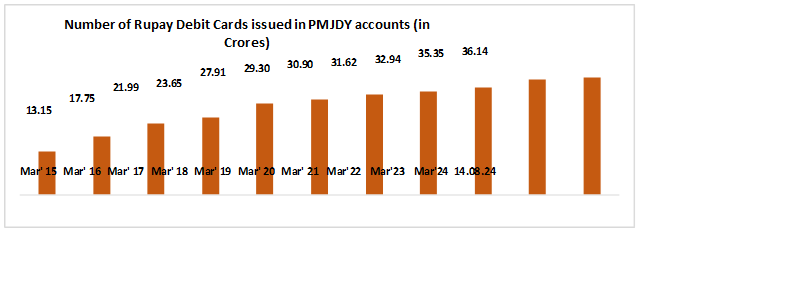

- RuPay Card issued to PMJDY account holders: 36.14 crore (As on 14th August’24)

36.14 crore RuPay cards have been issued to PMJDY accountholders: Number of RuPay cards & their usage has increased over time.

With the issue of over 36.06 crore RuPay debit cards under PMJDY, installation of 89.67 lakh PoS/mPoS machines and the introduction of mobile based payment systems like UPI, the total number of digital transactions have gone up from 2,338 crore in FY 18-19 to 16,443 crore in FY 23-24. The total number of UPI financial transactions have increased from 535 crore in FY 2018-19 to 13,113 crore in FY 2023-24. Similarly, total number of RuPay card transactions at PoS & e-commerce have increased from 67 crore in FY 2017-18 to 96.78 crore in FY 2023-24.

PMJDY’s success highlights its mission-mode approach, regulatory support, public-private partnerships, and the importance of digital public infrastructure like Aadhaar for biometric identification. It has enabled savings while providing credit access to those without a formal financial history, making them eligible for loans from banks and financial institutions.

Get the latest news updates and stay informed with FELA NEWS!